“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

– Mark Twain

It seems wherever one looks, negative headlines and sentiment abound. There’s talk of economic conditions worsening, a recession looming, and the next crisis unfolding. The narrative today is largely focused on inflation and interest rates, both of which were impacted by the pandemic and further exacerbated by the devastating conflict in Eastern Europe.

To be sure, pundits issuing bold forecasts during periods of heightened market volatility is nothing new. Of course, most will only tell you that you need an umbrella after it starts raining. (As the saying goes, God created market strategists to make weather forecasters look good.)

In this note, we’ll review where things stand, explore the various factors that are driving returns, and examine what it all means for investors going forward.

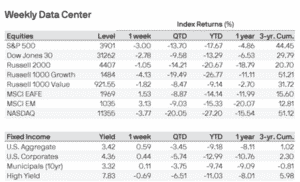

Source: JPMorgan, Data as of 5/23/22

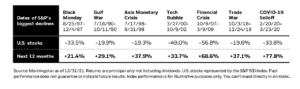

We are currently experiencing one of the worst starts to the calendar year for markets, with the S&P 500 down 18% through the third week of May. Though technically shy of an official bear market (as measured by a decline of 20%), specific sectors and asset classes – including tech stocks, small caps and crypto – are decidedly there already. Even bonds – historically a safe-haven during periods of volatility – have struggled to start the year.

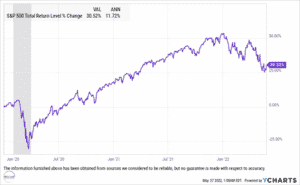

Declines such as these may be disconcerting, but it’s important to zoom out for a deeper perspective. Most investors would be surprised to learn that even after accounting for recent volatility, the S&P 500 is still up over 30% since the pre-COVID highs. In other words, despite the historically bad start to the year – and the pandemic-fueled crash that’s still fresh in our minds – markets have returned nearly 12% annualized over the past two and a half years.

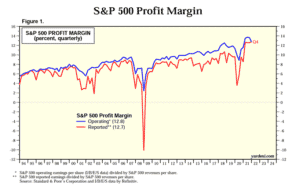

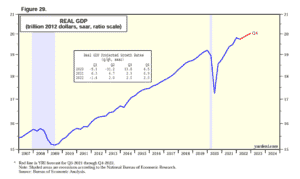

While this may seem incongruous with the prevailing narrative, it’s important to separate sentiment from fundamentals. And the fundamentals are surprisingly strong, given just how weak the sentiment has become. For instance, measures of industrial production and manufacturing continue to rise. Personal income is higher than it’s been at nearly any point in history. Unemployment is at historic lows. Corporate balance sheets are strong, profit margins elevated, and earnings continue to exceed expectations. Real consumer spending has also been expanding, albeit as consumers shift their spending from goods to services. While recessions are only confirmed after the fact, most leading indicators do not seem to be signaling that one is imminent.

Instead, what we are seeing looks more akin to the average correction, which tends to occur every 3-4 years. To date – both in terms of depth and duration – recent price activity seems in line with historical averages (a ~14% decline lasting roughly 4-5 months). And, while the equity markets may certainly continue to experience volatility in the months ahead – particularly as the Federal Reserve pursues its stated path of aggressive rate hikes – there are, in fact, reasons to maintain a more constructive outlook. In other words, much of the fear that is no doubt pervasive today seems centered around what could happen, as opposed to what is happening.

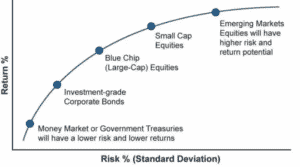

As we’ve highlighted in the past, volatility is a feature of the markets, and not a bug. Though unsettling in the moment, the realization of excess returns in the stock market is a function of accepting, or even embracing risk. This concept is known as the equity risk premium, and it has been well documented across various market cycles and regimes.

Though we can’t eliminate risk altogether (in the pursuit of a reasonable real return), by diversifying broadly across asset classes, styles, sectors, and regions, we are able to significantly mitigate it. Furthermore, by avoiding concentrated positions, we eliminate the asymmetric risks for which investors are not adequately compensated, in our view.

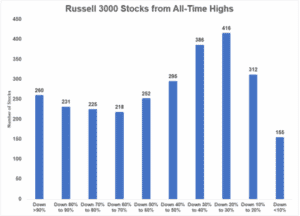

Nowhere is this more evident than in the divergence we are witnessing between individual stocks and the broader market. In a recent examination of market internals, investor Ben Carlson notes that across the Russell 3000 index – which effectively represents the entire US equity market – nearly 1 in 10 stocks are currently down 90% from their highs, and 1 in 5 are down 80%. In fact, nearly half of all stocks are down 50% or more. Remarkably, though, the index itself is down just 18%.

Source: Ben Carlson, A Wealth of Common Sense, Data as of 5/10/22

This divergence is due to the outperformance of a select group of stocks and sectors, most notably energy, utilities, and consumer staples. As eToro’s Callie Cox notes, “outside of energy stocks ― which have blown other sectors out of the water ― the top three performing S&P 500 stocks year-to-date have been a potash miner (Mosaic), a fertilizer manufacturer (CF Industries), and a medical supplies producer (McKesson). S&P 500 utilities companies and food, beverage, and tobacco manufacturers are flat on the year. We call these value stocks, companies whose shares trade closest to the value they provide today…”

It’s fair to say that boring is back, and diversification remains undefeated. For those investors heavily weighted towards tech innovation and disruption, the past few months resembled the Great Depression. For those with balanced portfolios, the experience has been quite different. By diversifying broadly and avoiding what we deem to be uncompensated risks, we’re able to significantly reduce the magnitude of drawdowns and shorten the subsequent recovery time.

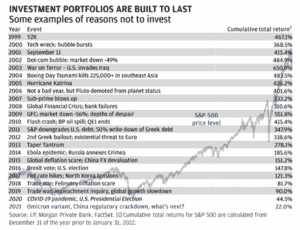

Looking ahead, there are undoubtedly risks and headwinds to grapple with. Inflation is at 40-year highs and the Federal Reserve has no choice but to raise rates in order to rein in demand. And there’s of course the chance they overshoot in this regard and derail an otherwise healthy economy. There are geopolitical concerns, as well, which may persist for longer than we’d care. Not to mention the supply chain disturbances and shortages we’re experiencing, and the lingering threat of another COVID wave. But when have there not been risks and headwinds such as these? The details may change, but the theme stays the same. JPMorgan highlighted major events spanning each calendar year since the turn of the century. The total returns that followed from each point forward through today – for those who simply stayed the course – are nothing short of spectacular.

They say history does not repeat, but it often rhymes. Over the years, we’ve seen headline risks give way to heightened volatility. In some cases, corrections do turn to bear markets, and bear markets to recessions. The prospect of a prolonged decline can never be entirely discounted. Yet time and again, these sharp selloffs pave the way for significant recoveries in the months and years ahead.

Source: BlackRock

We expect this time will be no different in that regard and urge investors to maintain the patience and discipline that makes for successful long-term investing. As always, should you have any questions or concerns, please don’t hesitate to reach out.