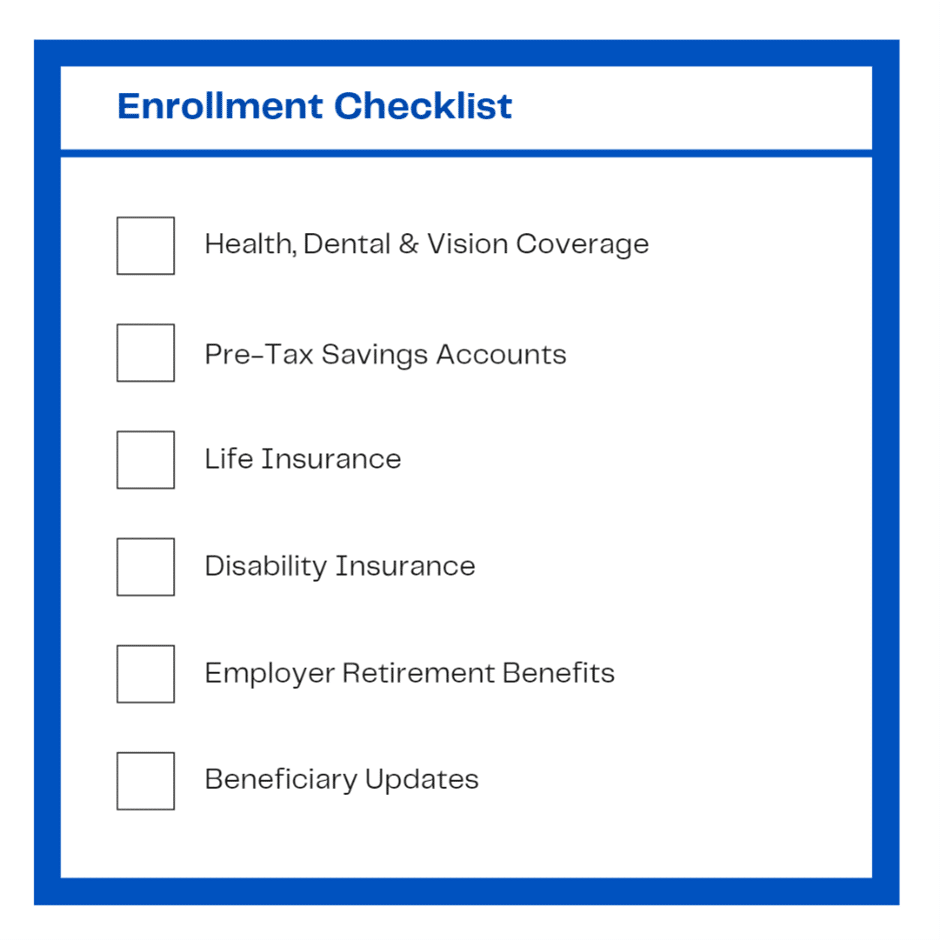

Employee Benefits Open Enrollment season is here! We would like to share a few thoughts on what to consider when evaluating your employee benefit options and how we can help.

When is your Open Enrollment window? The window for evaluating your annual benefit choices varies across employers. Many of you may have recently been notified that enrollment is now or soon, while others may go through open enrollment at a different time of year. It is best to check with your benefits department to find out when your open enrollment period is

When choosing your Health Insurance, there are many factors to consider. Medical expenses are unpredictable and vary from year to year. Some plans may seem more comprehensive, but it does not mean they provide more value even in high medical cost years. Our planning team at Revolve has developed a health insurance calculator to help illustrate potential cost differences between your plan options. We can also help evaluate vision and dental insurance offered through your employer.

When choosing your Health Insurance, there are many factors to consider. Medical expenses are unpredictable and vary from year to year. Some plans may seem more comprehensive, but it does not mean they provide more value even in high medical cost years. Our planning team at Revolve has developed a health insurance calculator to help illustrate potential cost differences between your plan options. We can also help evaluate vision and dental insurance offered through your employer.

Are you optimizing your pre-tax savings accounts? There are 3 types of medical savings accounts generally offered: Flexible Spending Account (FSA), Health Savings Account (HSA), and Health Reimbursement Arrangement (HRA). For those of you who pay for dependent care, a Dependent Care Flexible Spending Account (DCFSA) may help lower the costs of these expenses. For 2024, FSA annual contribution limits are $3,050, but are projected to increase to a maximum of $3,200. HSA contributions are increasing to a maximum of $4,150 for individuals and $8,300 for families.

We can help walk you through the benefits and drawbacks of each of these savings’ accounts, along with better understanding how you can contribute to and use each of these accounts.

This is a good time to see if your current coverage is suitable, or if additional/alternate coverage would better fit your needs. We can help you understand employer-based coverage vs privately placed insurance, whether your coverage is portable, and if premiums may increase in the future.

Employer Sponsored Retirement benefits should also be reviewed at this time. It is a good idea to revisit your current savings goals and available investment allocation options on an annual basis. For 2024, the maximum contribution for 401k accounts has increased to $23,000. The catchup limit is $7,500 if age 50 or older by the end of 2024 calendar year.

If eligible for employee stock purchase or deferred compensation programs, this is the time to elect your deferrals for the upcoming year. We can help walk you through the benefits and drawbacks of any program options available to you. It is also a good time to review your beneficiary designations to see if any changes or updates are needed.

Open Enrollment is an important time of year to review your benefits. Employer plan options can change from year to year, as can your personal needs, so it is important to review your benefit elections during this time. We can work together to help evaluate the options available for you and your family.

If you have any questions or need assistance, please reach out to the Revolve Planning Team at [email protected] or by calling 201-373-2163.